Bay Area Real Estate Market Update - January 2023

Nobody wants to buy and nobody wants to sell, that’s the story of the Bay Area housing market entering 2023. So who benefits and where do we go from here? We’re at a very interesting time in the housing market in that we’re in a bit of a stalemate. Many buyers have exited the market because high interest rates have made homes considerably less affordable for anyone needing a loan or wanting to finance their purchase. With fewer buyers in the market, conventional wisdom holds that we’re now in a buyer’s market. While it’s certainly the case that the market is more friendly to buyers than it was in the early part of last year, inventory remains low and absorption rate statistics suggest that in most parts of the Bay Area, we remain firmly in a seller’s market. Why is inventory low? Because many homeowners refinanced over the past several years and have mortgage rates on their homes at half or lower than half the average current rate for a 30 year fixed mortgage, which is 6.14%. So generally, unless there’s an external motivating factor, sellers are holding on to their properties. With low demand and low inventory, that means there are opportunities in this market for both buyers and sellers. Buyers have the ability to be more choosy about the home they plan to buy and in many cases, have leverage to negotiate the purchase price, get contingencies and extract concessions from sellers. That’s particularly true if the sellers cut corners when putting the home on the market, or if they overpriced their home. Those properties are the ones that have been sitting for a long time. On the other hand, due to the lack of inventory, the sellers who do prepare their home well for sale, get pre-sale inspections and price the home in line with the market are also very well positioned and doing well in this market. Quality, well-priced homes are still in high demand in this market and are selling quickly, often above list price. The reason comes down to supply and demand and their value in this scarce market. Those who are perhaps best positioned in this market are cash and institutional buyers who are not substantially impacted by the high interest rates and are well positioned to benefit from home prices that have come down from their peaks. Cash buyers are also very well positioned to negotiate with sellers. I anticipate lots of resale homes in 2023 being gobbled up by institutional buyers and investors, many of which may never return to the resale market. That could depress inventory for years to come. Looking at statistics across the Bay Area, focusing on San Mateo, San Francisco, Marin, Alameda, Santa Clara and Contra Costa counties, December 2022 was a bit of a milestone as it was the first month since March of 2012 that the sales to list ratio for single family homes dipped below 100% across the region, coming in at 99.8%. Regional median days to sell jumped to 23 from 18 in November, its highest level since January of 2020. Looking at the data by county, San Francisco and Alameda county both had sales to list ratios exceeding 100%, while the remaining counties fell below that mark. That said, every county in the region had sales to original list price ratios below 100%, with San Mateo and Santa Clara counties at the bottom at 95.3%. That suggests that price reductions are becoming the norm in this market which is considerably different than the typical environment of overbidding. Median days to sell peaked in Marin at 33 days, with single family homes in Santa Clara selling in a median of 17 days, the lowest in the region. Median sales prices as well as price per square foot numbers are also considerably down from their peak levels. San Mateo topped median prices for single family homes in Q4 in the Bay Area, at $1.728M. That’s 18% off from the peak of the market of $2.1M in Q2 of 2022. Price per square foot in San Mateo county was $1089 per square foot in Q4, off 17% from the peak in the second quarter. Year over year, the numbers aren’t quite as bad as there was a 9% reduction since Q4 of 2021 in median price and price per square foot. Those numbers are mirrored throughout the Bay Area. Q4 median prices in San Francisco were 21% off their peak in the second quarter and down 13.5% year over year. Again, context is required when looking at these numbers because low interest rates led to a surge in demand during the pandemic, so housing prices soared due to rising demand and limited supply. So while the falloff from the top of the market has been precipitous, the floor has certainly not fallen out of the market. Q1 of 2020 was the last quarter prior to the pandemic. The cumulative rate of inflation since that point was 13.1% which is substantial and has led to the increased interest rates. Adjusting for inflation, the only Bay Area county of the six measured that did not outperform inflation since the beginning of the pandemic with single family homes was San Francisco county. Everywhere else, values have outperformed inflation. That is generally why real estate is generally thought of as a good hedge against inflation. The condo market throughout the Bay Area has largely mirrored the single family housing market, although condos typically sit on the market longer than single family homes. While many people think that we’re in the midst of a crash of the housing market, that simply is not the case. Low inventory is keeping values up even as demand has tapered off. I expect an uptick both in inventory and demand in the Spring as more stable interest rates are beginning to bring buyers back into the market. The floor never really fell out of the market nor does it look to – there has simply been a bit of a reversion to the mean after a period of record demand spurred by record low interest rates. If you have something to say, please drop a comment below or email me at sean.engmann@cbrealty.com. If you’re thinking of buying or selling and would like for me to help, please give me a call at 650-238-9210. Thanks for your interest, and I look forward to connecting soon!

Read More

Bay Area Real Estate Market Update - August 2022

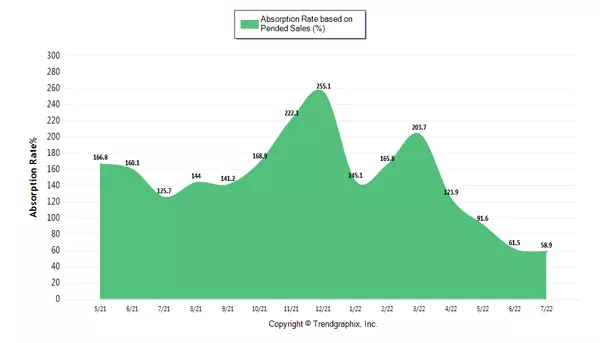

Is the Bay Area real estate market really shifting? Is it about to crash? Let’s dig deep into the market to separate the hype from reality and find out what’s really going on right now in the market.The perception right now is that the market is shifting and the data supports that perception. With that said, context is extremely important in order to properly evaluate what’s happening and weed out the hyperbole. The reality is that the shift that we’re experiencing now is a return from an extreme seller’s market to the type of seller’s market we have experienced for the better part of the last 10 years.The shift can be seen across many metrics, but let’s start with the absorption rate. Focusing on single family homes in San Mateo and Santa Clara counties, the absorption rate, measuring pending sales versus inventory, has precipitously fallen as interest rates have risen, going from 203.7 percent in March to 58.9 percent in July. Keep in mind, traditionally, anything above 33 percent is considered a seller’s market. For perspective, the absorption rate in the same area in the first quarter of 2008 was at 10.2 percent. Virtually all of the drop in the absorption rate results from a reduction in demand as interest rates took off from an average of 3.9 percent on March 1st to 5.6 percent on August 19th with a peak of 6.28 percent in June. The supply side continues to be very tight with the number of new listings Bay Area wide in July off nearly 20 percent year over year. In fact, the number of new listings on the market has declined year over year for 12 consecutive months. A falling absorption rate despite fewer new listings points to a substantial reduction in demand. Taking a look at metrics that are more indicative of what’s happening on the ground, the shifting dynamics of the market as well as the fact that we remain in a strong seller’s market are both apparent. Bay Area wide, the sales to list ratio in July fell to 104.5 percent from 109.5 percent in June and the median days on market increased by 3 days to 14. In April, the sales to list ratio peaked at 116.5 percent with a median days on market of 8. That means that homes are taking nearly twice as long to sell as they were at the peak of demand and that homes are selling much closer to list price. Both are indicators of reducing demand and adjustments being made to pricing and marketing strategies.Looking at county data, it’s important to note that in every Bay Area county, the average home is still selling above list price in 3 weeks or less. Both are indicators of a market that still favors sellers, though demand has fallen off to a level closer to the available supply due to money becoming more expensive.In terms of median price, values fell across the Bay Area from June to July, with the largest drop occurring in San Mateo county with the median price dropping to $1.8 million from $2.048 million in June. The median home sales price in San Francisco also fell to $1.67 million. Median prices throughout the Bay Area have been trending down since their peaks in April, and while falling prices are certainly alarming for home owners, it’s important to put those numbers in context. The median home in the Bay Area in July sold for more than 20 percent more than pre-pandemic levels.So what’s happening on the ground? The most obvious thing is that homes are now selling and being evaluated at closer to list price than they had been. The falloff in median sales price correlates well with the reduction in sales to list ratio, meaning that buyers are no longer paying as high a premium above list price as they were at the peak of the market. In San Francisco and Alameda, we’re still seeing sales to list ratios closer to 110 percent. Those numbers are off 10 to 15 points from their levels in April. The buyers who are still in the market are evaluating homes closer to the list price and are less concerned about getting into bidding wars. We’re also seeing more below list offers and more contingent offers, meaning getting a property ready to sell is as important as ever to sellers.Where do we go from here? Interest rates are likely to continue to rise, which may further stifle demand and push people out of the market. I believe median prices will begin to stabilize as buyers and sellers get acclimated to the new conditions of the market and we settle into a more normal market. I don’t see the conditions necessary to precipitate a collapse of the market, particularly in the Bay Area where homeowners hold lots of equity. With money more expensive, there will be fewer buyers, and with homeowners holding lots of equity and mortgages at historically low rates, inventory will likely remain low, meaning reduced volume until we see either a significant reduction in rates or an event which leads many people to sell. Neither appears to be on the horizon right now.

Read More

Win in a Seller's Market without Loads of Cash

Hey everyone. As you know, we’re in the midst of an extremely strong seller’s market here in the Bay Area which shows no signs of slowing down. That means that things can be extremely tough if you don’t have a lot of cash available. While having cash on hand is a huge advantage, buyers who don’t have huge cash reserves can still be successful in this market. In fact, I’ve recently helped two buyers get instant equity in their new homes despite having less than 20% to put down. I’ll explain how. Number one – understand the seller’s thought process. Knowing what the seller wants makes it easier for you to give it to them, which is the key to making a deal. All sellers are different and have different motivations, but, generally speaking, they want the best price for their home in the least amount of time, and they want to avoid any possibility of the deal falling through. Some sellers may have other motivations which can be used to your advantage if you find them. That includes if they need a rent-back to find another house or if they need to close quickly, so they can get into contract on a replacement property. A good Realtor can help you learn more about the seller’s motivation and help you use that to craft a strong offer. The reason why cash is generally king is because it minimizes the number of moving parts and limits chances for the deal to fall through, but strong offers with a loan that address the seller’s needs can win over lesser cash offers. Number two – know your own limitations. Ultimately, the seller will accept the highest offer that best fits their needs and has the highest likelihood of performing. If you’re in a limited cash position, what the home will appraise for is of critical importance. It keeps your offer tethered to the market value of the home and keeps you from overbidding. The less cash you have, the closer to the appraised value you need to be. Why? Because your lender will only loan you up to the value of the appraisal. If you don’t have any way to make up the difference, you won’t be able to perform on the contract. Even if you’re willing to take the risk, the sellers and a good agent will understand your financial position and the risks involved, by accepting your offer. The solution? Get comparative market analyses for every property you’re considering writing an offer on and check with your agent about the likelihood of your offer to appraise. In appreciating markets, the appraised values often lag the market values and present a risk. Avoid making offers on properties where there is a risk of a low appraisal. Number three – get as much of your loan underwritten in advance as possible. You want to be able to close quickly and you need to be confident that you will be able to get the loan before writing the offer. Number four – write non-contingent offers. Contingencies give you as the buyer a chance to back out of the contract and have your deposit refunded if certain contingencies occur. The option for you to cancel is generally not palatable to the seller because it could cause the home to go back on the market, so offers with contingencies are generally very weak in a seller’s market. That means you should do enough diligence on the property to be comfortable that there will be no unwelcome surprises. Please note that this only applies to homes where the seller has provided detailed inspection reports with the disclosures. If no reports are provided, you should strongly consider passing on that home as there’s generally a reason why those reports weren’t provided. Number five – focus on properties that have been on the market for an above average period of time. While these aren’t as sexy as the new homes on the market, that means there is less competition. The home may have been priced incorrectly, or there may have been some sort of an issue. Either way, these homes represent an opportunity because the lack of competition gives the buyer an advantage. You could negotiate price on these homes, or add contingencies which could leave you with a better deal and much more peace of mind than competing against multiple offers. Number six – identify properties represented by out of area agents. Out of area agents may not be as well in tune with the local market, or might make mistakes entering the home into the MLS which limits its visibility. These out of area agents could be part-time agents who are related to the seller or representing the seller on a buy side transaction somewhere else. They could also be charging a below market commission and providing a commensurate level of service. Identifying these homes, especially early, right when they come on the market, could result in a great deal. Number seven – use your agent to find off-market opportunities. There are many sellers who want to sell without the hassle of prepping the home for market and having their lives turned inside-out for showings and who are willing to sacrifice some of the potential value of their home for the convenience. If they are smart, they will work with an agent to effect an off-market sale rather than seeking out a well below-market cash offer. Good agents know of off-market possibilities where buyers can avoid much of the competition of the open market. Finally, when it comes to making offers in a multiple offer situation, you want to be at the highest price with the best chance of a smooth closing. Leading with your highest and best offer is a good strategy if you and your realtor expect the seller to treat the process like a blind auction, and you don’t want to miss out. Thorough seller’s agents will go through the offers and try to generate competition amongst the multiple offers or present multiple counter-offers, so that should be taken into account when writing the offer. The goal of the first offer, at a minimum, is to be in the conversation for any counter offers. If you enjoyed watching the video above, please like, comment or subscribe. If you live in the Bay Area and would like my help buying or selling a house, please click on the link in the description. Thanks, and best of luck in your home search!

Read More

Recent Posts