Bay Area Housing Market Update - November 2024

Bay Area Housing Market Update - November 2024 Hi everyone, this is Sean Engmann with your housing market report for November. The elections are in the rearview mirror and though most people have been focusing on the presidential election, there were a number of key state and local chan

Read More

Bay Area Real Estate Market Update - January 2023

Nobody wants to buy and nobody wants to sell, that’s the story of the Bay Area housing market entering 2023. So who benefits and where do we go from here? We’re at a very interesting time in the housing market in that we’re in a bit of a stalemate. Many buyers have exited the market because hig

Read More

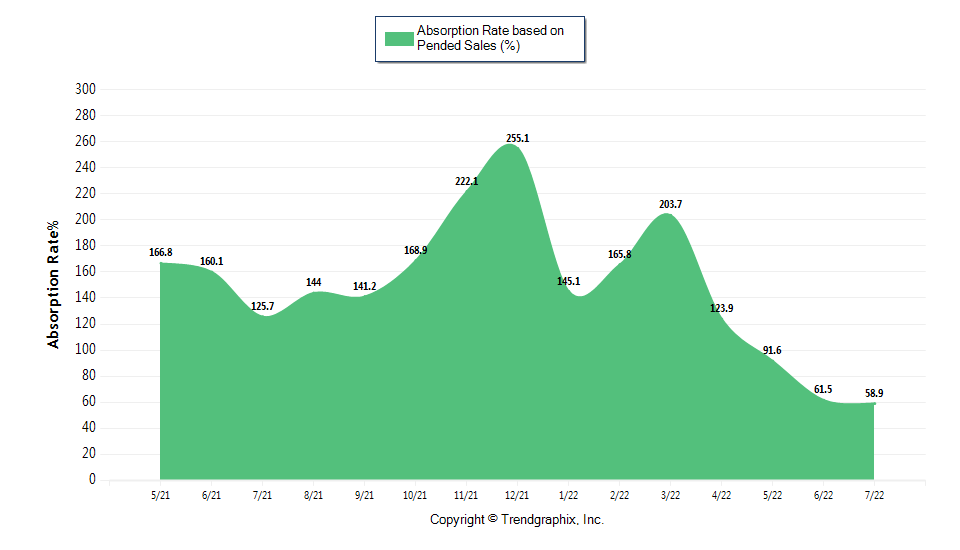

Bay Area Real Estate Market Update - August 2022

Is the Bay Area real estate market really shifting? Is it about to crash? Let’s dig deep into the market to separate the hype from reality and find out what’s really going on right now in the market.The perception right now is that the market is shifting and the data supports that perception.

Read More

Recent Posts