Things to Avoid Doing When Buying a House

Prospective homebuyers should keep their debt to income ratio in mind as they work on the pre-approval process and through the purchase process. That means avoiding large credit purchases, such as buying a new car or opening up a new credit card account as these can impact both credit score and the debt to income ratio. It’s really important to note that a pre-approval does not guarantee the loan. Once the home is in contract the loan will go through the process of underwriting which is a very detailed process for verifying all of the information provided by the buyer, and things can change during underwriting, especially if large purchases were made after pre-approval, or information is discovered that was not previously disclosed. One of the biggest mistakes homebuyers make is increasing their debt after pre-approval which could derail the entire purchase.

10 Questions to Ask a Potential Lisint Agent

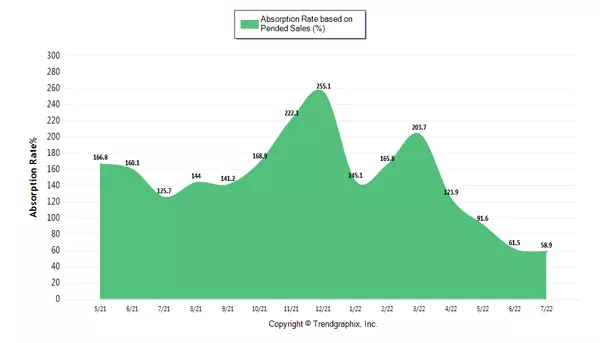

So, you’re thinking about selling your home and it’s time to hire an agent, but you don’t know what questions to ask to make sure that agent is on top of their game. You’re not alone. According to the National Association of Realtors, over 70% of sellers go with the first agent they meet. Realtors aren’t interchangeable, many are great, others are not, so it’s important you know what to ask to make sure you get the right person for such a big transaction, so here are the 10 questions you should ask every agent you interview. Number 1 – What do you view is the role of the listing agent? This is the essential job description, and you’d be surprised how much it can vary from agent to agent. Some agents think the role is to put the property on the MLS and then disappear, others want to micro-manage every aspect of the transaction. It’s critical that you and the agent are on the same page here. Numbers 2 through 4 – What are the median days on market in our neighborhood right now? How many months of inventory is currently available in our area? What is the average percentage of the list price that homes are selling for in our area? These questions probe the agent’s knowledge of the local market, which is essential to getting top value for the home. Agents who go into a listing meeting without this knowledge are unprepared. Number 5 – What list price and pricing strategy would you recommend for our home and why? Some agents will try to “buy the listing” by claiming to be able to sell a home for an inflated price just to get the listing. Agents should have a list price and pricing strategy informed by comps and market conditions and be able to articulate the strategy clearly. It’s also important for you to be on the same page as your agent as to the strategy to avoid friction down the line. Number 6 – What is your plan for marketing the home? Again, this can vary dramatically from agent to agent, so make sure you probe deeply and are satisfied with the plan to market your home. Number 7 – How will you know if and when it becomes necessary to adjust the price? The agent should explain when price reductions may be warranted and the conditions upon which they can be used. Number 8 – How can we be sure that we’ll receive the proper attention from you personally? Some Realtors work independently, others work on teams with other Realtors. If you’re interviewing a team, you may rarely interact with the team lead during the transaction so make sure your fully satisfied with the other members of the team. Number 9 – What sort of reporting do you provide and how often do you provide it? Selling a home is stressful enough, and it’s infinitely more stressful when you don’t know what’s going on. Make sure you’re on the same page with regard to the frequency and type of reports you will receive at every stage in the process. Number 10 – If something goes wrong, how do we know you’ll be able to solve it? They say the best battle plans don’t survive first contact with the enemy, you need to be sure that your agent has what it takes to be a problem solver. By asking these questions you should be able to get a much better feel for the quality of the agent that you’re interviewing. One other question that you absolutely should ask is whether the agent also intends to represent a buyer, which could create a conflict of interest. If you’re thinking of selling and have any further questions, please drop a comment or click on the link in the description to connect with me.

7 Steps to Properly Evaluate Offers

Perhaps one of the most overlooked but most critical things in tme sinellg process is properly evaluating the offers thathe entire h come in on your . home. oI’m Sean Engmann, a Realtor and MBA. Especially in strong seller’s markets where there may be multiple offers, it is absolutely essential to be able to effectively evaluate every offer so you can best assess who can perform and who may be full of hot air. Why is it so important? Because if you pick a weak offer your escrow is going to be a nightmare, and if the buyer can’t perform, you’ll need to start at square 1 which not only costs you lots of time, but likely lots of money too. The best offer isn’t necessarily the highest price, it’s the highest price with the best chance of closing at that price. With that in mind, here are 7 things that I look for when evaluating offers. Number 1. The price and the terms. To start, I take everything at face value and rank the offers based upon the price and the terms. Generally speaking, the higher the price, the fewer the contingencies, the absence of any encumbrances such as the need to sell another home and the shorter the close the better. Number 2. The type of financing and the amount financed. At this point, I’m still taking everything at face value. Generally speaking, the lower the percentage of financing needed, the better the offer, with all cash offers being the most preferable. All things being equal, after these two steps it should be easy to rank offers in a multiple offer situation, or to determine in a single offer situation, whether the offer is palatable enough to warrant further scrutiny. Number 3. I’m going to look at the buyer’s cash position and how much documentation has been provided. Cash position is very important even if the home is being financed because cash can solve problems that could arise during escrow, such as a low appraisal, or if they don’t get approved for a loan in the amount they want. The amount of verifiable documentation is critical because some buyers try to show themselves to be in a better cash position than they actually are. Some even will claim to be able to make an all cash offer when they don’t have the means to do so. On the other hand, if the buyers show a lot of cash there could be an opportunity to be aggressive on a counter-offer depending on the situation. Number 4. If the buyers are getting a loan, I will carefully review their pre-approval letter and contact the lender directly. All pre-approval letters are not treated equally. Pre-qualification letters can come easily with little to no verification of financial information. For most pre-approval letters, at least some level of scrutiny likely has been done to verify income and debts. The most reliable pre-approval letters are underwritten pre-approvals where the buyer has already gone through the underwriting process. Whether or not a financing contingency is in place, the goal is to determine how much work has been done by the lender to vet the buyer in order to make sure the buyer can perform. Most lenders are overconfident in their ability to deliver and are incentivize to overrepresent the buyer’s ability to get the loan because in most cases they are compensated when the loan is funded. Another item of note on loans is that the type of loan is very important as well. Loans such as FHA loans have certain criteria that need to be met in terms of property condition. While those types of loans are disclosed on purchase contracts, others, such as bank statement loans and interest only loans are not. These types of loans can be much more complicated and require substantially more documentation than a standard loan, so finding out if this is how the buyer plans to finance the purchase is important. For other types of loans such as private financing or hard money loans, it’s important to vet the lenders to be sure they can actually issue the loan. Number 5. Determine whether the home will appraise at the offered purchase price. This is more important for those in weaker cash positions. Whether or not an appraisal contingency exists, if the home does not appraise at value and the buyer doesn’t have the cash to make up the difference the price will either need to be reduced or the deal will fall through, both bad outcomes for the seller. Number 6. Who’s representing the buyer? Do they have an agent and if so how professional is that agent? A buyer represented by a solid agent will generally present a clean offer and have a better chance of performing on the offer than someone representing themselves or using an unprofessional agent. Lastly, number 7, does everything about the offer make sense? If there are still red flags at this stage, generally there’s something off about the offer. Unfortunately, some buyers are disingenuous with their offer hoping to beat out other competitors and then negotiate more favorable terms in escrow. These are typically nightmarish escrow periods because once the contract is ratified, the leverage shifts to the buyer. Typical examples are dragging out the process, trying to reduce the price after inspections, trying to negotiate the price down based on a low appraisal and on and on. The goal is to sniff these people out before ratifying the contract so you can either negotiate on your terms, or just find another buyer. The old adage holds that if you think something’s too good to be true, it probably is. If there are any atypical terms included with the offer, they need to be fully evaluated. I hope this video gave you a bit more insight into the importance of evaluating offers and picking the right one. If you have any further questions, just drop a comment or click on the link in the description.

Recent Posts